Economic Masonry - A Clever New Way Of Growing Your Wealth Through Business Corporate Funding

ATTENTION: Business Owners That Need Funding

Stop Letting Your Credit Score Hold You Back!

Work with our credit partners to enhance your credit & get the funding you need.

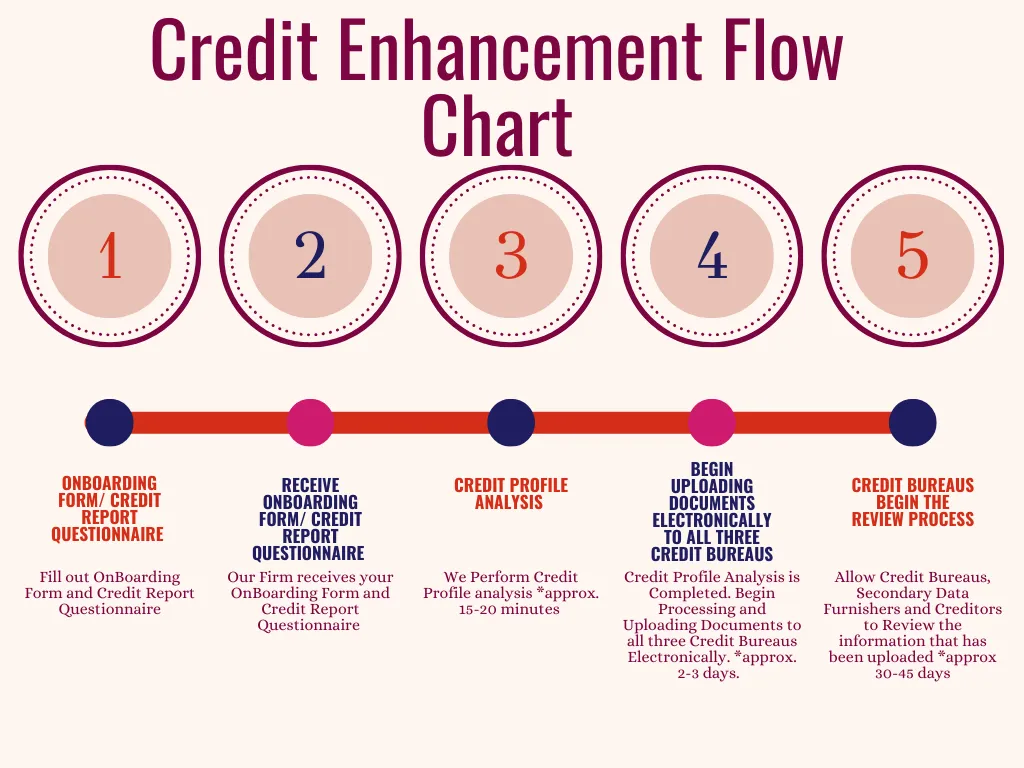

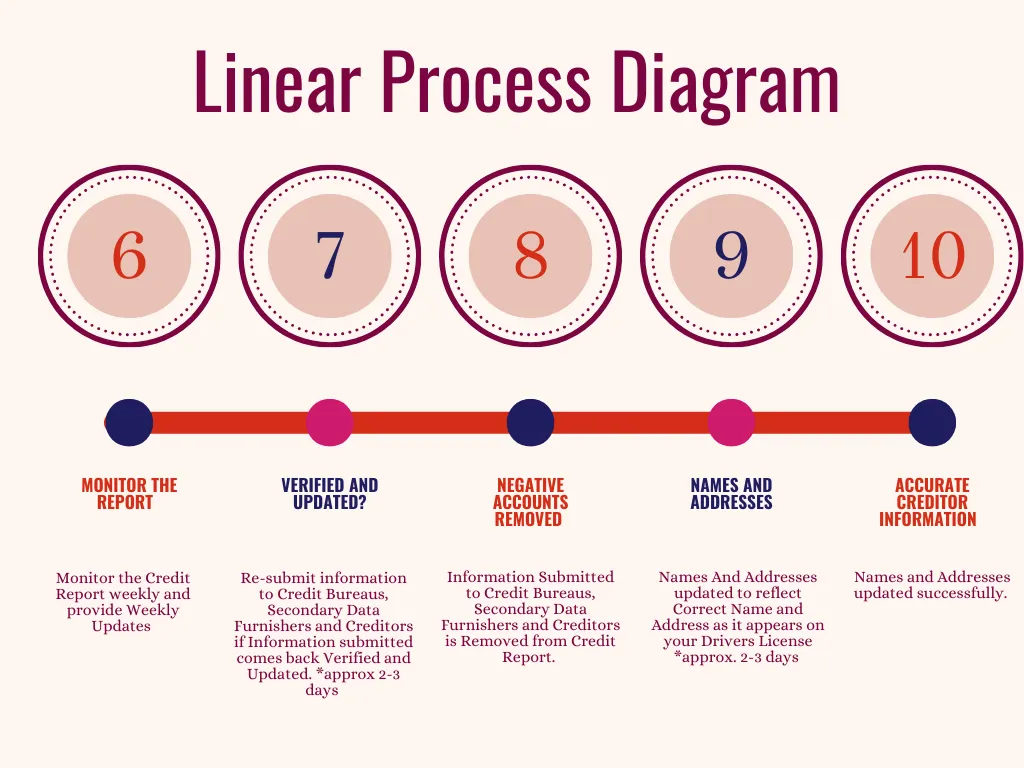

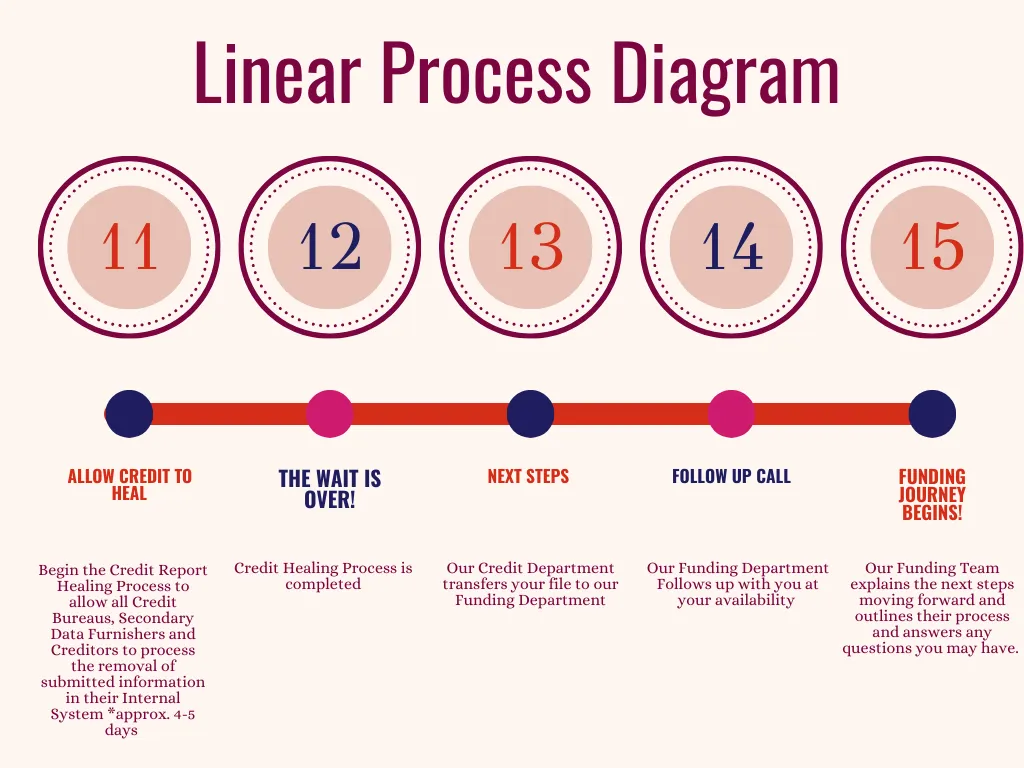

A Detailed Breakdown Of Our Process

PRICING

Plan Options

Do It Yourself

Credit Enhancement

$497

Do-It-Yourself Credit Enhancement Masterclass

Learn strategies to enhance your credit

Lifetime Access to the 360 CEO's Community.

Done For You

Credit Enhancement

$1,497

Dedicated Consultant That Will Enhance Your Credit For You

Personalized Credit Dashboard To See Real-Time Credit Updates

Access To Our Credit Enhancement Masterclass

Lifetime Access to the 360 CEO's Community

STILL NOT SURE?

Frequently Asked Questions

You've got questions and we've got answers

What is the first step I should take?

First, fill out the OnBoarding Form and Credit Report Questionnaire. This way, our firm can collect your contact information and understand what is on your Credit Report.

How do I schedule a call?

Click this link to Schedule a free consultation call

What do you mean “Allow Credit to heal”?

When our Firm assists you with your Credit Report to remove negative and derogatory information, we like to allow 4 or 5 days for all of the Creditors, Credit Bureaus, Secondary Bureaus and Data Furnishers to update the information that has been removed in their Internal System. That way, we can ensure there will be no hiccups or speed bumps when assisting you with your funding. In some cases, it may show that the negative information has been removed from your Credit Report. But, a Creditor or Data Furnisher may take a few days to update the information in their internal system.

How long does it take for Negative and Derogatory information to be removed from a Credit Report?

Although we cannot give you an exact date when the information will be removed, we can assure that the Credit Bureaus have 30-45 days to review the information.

Is there any way I can see when I will get the results? Even though you cannot tell me when I can get results?

Yes! When you login to your Experian, Equifax, or TransUnion account and go to your notification center. It will display the exact date the review process will be completed.

What if the information that was submitted is returned as verified and updated? Does this mean the account or derogatory cannot be removed?

No! Even though the submitted information comes back Verified and Updated, it does not mean it cannot be

removed. Since we upload all documentation electronically, our firm can see your results in real time. If

the information is verified and updated, our firm will incorporate additional strategies to remove the account or derogatory information from your credit report.

What should I do if I spoke to a Collection Agency that wants me to pay a debt I owe? Does this mean I have to pay them?

No! In most cases, the Collection Agency cannot verify you are the individual that they have contacted even if you answer the phone. Even If you have validated the debt and taken responsibility. If you have validated a debt or assumed responsibility, don't hesitate to get in touch with Our Firm.

What do you mean, you “Upload” all Documentation Electronically?

Mailing information to the three major Credit Bureaus takes an extensive amount of time. To save time and provide you with faster results, Our Firm Uploads all of the documentation used to remove negative information from your report directly through Metro 2 and E-Oscar. An online software service used by the three major Credit Bureaus to communicate with Creditors, Secondary Data Furnishers, and Collection Agencies. By submitting directly through Experian, Equifax, and TransUnions portal, we can cut out 7, 8, or even 9 days out of the 30-45 day review process.

How long does it take for the three major Credit Bureaus to review the documents you upload electronically?

The three major Credit Bureaus have 30-45 days to review the information that is uploaded electronically under the FCRA and FDCPA. In most cases, the review process takes approx. 30 days. However, the three major Credit Bureaus are allowed an additional 15 days to perform an re-investigation of information.

What is the FCRA and FDCPA? What does it mean to me?

The FCRA (Fair Credit Reporting Act) Is a government regulation and set of laws that mandates and regulates all Credit Bureaus, Secondary Data Furnishers, Creditors and Collection Agencies. The FCRA outlines the laws and regulations that must be followed to comply with your rights as a Consumer. The FDCA (Fair Debt Collection Practices Act) is a government regulation that mandates and regulates all Collection Agencies. The FDCPA outlines how Debt Collection Agencies must contact you and how your information must be reported on your Credit Report.

What if a Creditor, Secondary Bureau, Data Furnisher, or Collection Agency violates my rights?

If you find that your rights have been violated as a consumer, you have the right to seek arbitration. Please contact Our Firm if you believe your rights have been violated.

TESTIMONIALS

What others are saying

"Late Payment REMOVED This Works!!!"

" I have now finally removed a stubborn late payment on my account! Thank you Derrick Whitehead, looks like I’m joining the 800 club!!!

🙏🙏🙏You are a hero!!! "

- Alan N.

"I Had No Idea How Things Worked In Business Funding"

" Thank you, Mr. Whitehead, for helping us do things properly to maximize funding for our businesses."

- Daniel B.

"I've learned so much. About credit & finance"

"This program is like no other. The staff is very helpful and friendly. I've been telling all my friends and family about this program. I've learned so much."

- David L.

economic masonry

DISCLAIMER: We are not brokers, finders, attorneys, credit specialists, or funders; we are consultants. The information provided by Alpha Inc. and/or its affiliates is from our perspective.

Copyright © 2023 - Alpha Incorporated - EconomicMasonry.com

Street address:

1534 Hillside Ave, Minneapolis MN 55411

Tel

9am - 5pm (EST) | Mon - Fri